Welcome to Forge the Future, your weekly guide to all things climate. In a big first for a major media organisation, this week The Guardian announced it is banning adverts from fossil fuel companies. Here’s a good take on why this is so important (HEATED also interviewed The Guardian’s interim chief executive about the topic).

Bloomberg is back with another list, this time their ‘Green 30’ for 2020 - 30 of the most important figures in the green movement for the coming year. Elsewhere, a new report (the most comprehensive yet on the issue) has highlighted the link between gender inequality and climate change. Climate change is both increasing violence against women and girls, and gender inequalities are also hampering efforts to tackle the climate crisis.

If you’re of an entrepreneurial bent, Conservation X Labs have opened up the third round of their Conservation Tech Prize - there’s $90k up for grabs for radical tech solutions to conservation challenges.

State of the Climate

CO2 levels this week: 414.09 ppm

This time last year: 411.06 ppm

East Africa is suffering from a massive outbreak of locusts, the most serious in 25 years (the most serious in Kenya in 70). The insects are thought to have multiplied due to climate change-induced wet weather in 2019, which created perfect breeding conditions for them. Over in Australia, Canberra has been under threat of wildfires for the past week, with the ACT declaring a state of emergency on Friday as more 20% of the state has burned.

New research warns of the dangers to the environment from ‘blue acceleration’ - the rapid growth in the exploitation of the seafloor as a resource. This covers everything from mining through fish farming to undersea cables, and is likely to boom as countries are realising the potential of their underwater territory. Another study has mapped over 100 tropical locations where biodiversity is collapsing due to climate change, extreme weather and human activity.

Visualisation of the Week

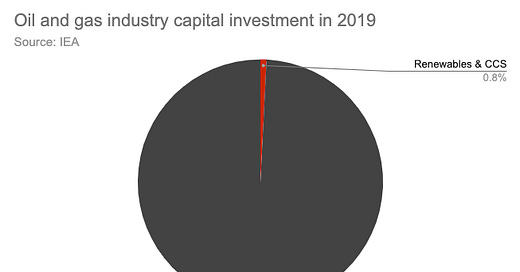

This week’s visualisation is a pie chart by Dr Simon Evans, made from a recent report by the IEA on the Oil and Gas industry, which pointed out that they invest less than 1% of their capex in low-carbon business.

The Rise of Green Finance

The finance world still seems severely underprepared for the climate crisis. A recent consultation found that 80% of finance executives believe that their firms lack well-developed strategies to manage climate risks. The past year has seen a gradual awakening amongst central banks too, as they realise that the issue is going to influence almost everything they do. This week saw a new report published by the Bank of International Settlements. The tome-like volume highlighted just how massive the threats to human civilisation are, and the key role central banks have in influencing the direction of the markets. The European Central Bank has also promised to take climate change into account as it begins its first review of monetary policy since 2003.

The last year or so has also seen some frustration as investors wanting to green their portfolios discover how few options there are. WWF (yes, the wildlife charity) just released a tool for portfolio managers to assess their investments, and everyone and their dog is leaping on the ‘sustainable investment’ bandwagon. So-called ESG (Environmental, Social and Governance) assets now total over $30tn, and rising rapidly every year, despite there being few guidelines on what exactly constitutes an ESG investment - some ESG funds include holdings in Tiffany & Co and Facebook.

However, ESG funds do offer some positives - many of the senior executives in finance dealing with ESG are women - a rarity in the male-dominated field. ESG used to be seen as a distraction and less important, and so somewhere where women were not seen as a threat. Now, with the rise of ESG, those same women are leading the charge, sitting in key decision-making roles, and the field offers a rare chance for gender equality in an industry that has struggled in this area.

To bring things back to the central banks, ESG and green investing are one of the key areas that central banks want to work on in the coming months. The EU in particular is trying to increase reporting requirements for companies around climate change in a bid to improve the green finance market, which it sees as a hugely important tool, and an area where it can take the lead. There’s been a rise in so-called ‘transition bonds’ - bonds issued by dirty industries to help finance their decarbonisation. However, at the moment, much like ESG, they’re not clearly defined, so whilst some seem to be well-intentioned, some decidedly suspect. They also fall outside the EU’s new draft frameworks for green bonds, so time will tell how prominent a role they end up playing.

News Highlights

US vs the Climate

New findings suggest that methane emissions in the central US from the oil and gas sector are nearly twice what the EPA initially estimated them as.

A new study suggests that it is indeed possible for an advanced economy such as California to become carbon neutral in 25 years, but it will require a massive transformation.

Forecasts from the EIA suggest that US emissions will fall just 4% by 2050.

New Jersey is drafting legislation that would force builders to take into account climate change and rising sea levels when developing new projects.

Starbucks is to reduce carbon emissions by 50% by 2030, both in direct operations and in their supply chain, along with implementing a number of other sustainability measures.

Approximately a third of Americans live in areas that experienced more than 100 days of degraded air quality, according to the Environment America Center.

EVs got significant airtime at the Superbowl, including GM’s announcement of a new electric Hummer, a car killed off because it was too fuel inefficient even for America.

Other News

Green hydrogen is on the agenda in Europe, as Belgium announces the world’s first commercial-scale green hydrogen plant, to be powered by surplus wind power. In Germany, a new national green hydrogen strategy has been announced as part of plans to transition to renewable energy.

The UK is having a mixed week. It announced that its ban on the sale of petrol, diesel (and now hybrid) cars will move forward from 2040 to 2035. The announcement was made as part of a launch event for COP26, the President of which was sacked shortly beforehand. She heavily criticised the government’s environment record in a scathing rebuttal.

UPS has invested in UK EV startup Arrival, alongside ordering 10,000 electric vans from them, with an option on 10,000 more. The delivery company has already committed to converting 1500 trucks to electric in New York, and has put in orders for electric trucks from Daimler and Tesla.

China’s oil demand has dropped by around 20% as the coronavirus scare slows the economy. The knock-on effect on world oil prices has OPEC considering limiting output.

The UK aviation industry has promised to target net zero emissions by 2050, although given an expected 70% growth, it’s unclear how they will achieve this.

India’s emissions look likely to rise sharply, with the carbon footprint of the Indian steel industry to more than triple by 2050. The Indian Government has also just approved 17 new coal mining projects, which will produce an additional 150m tons of coal in the next five years.

EVs made up 44.3% of new car sales in Norway in January. The numbers are high, but below the industry predictions of 50-60% for 2020.

Up to 90% of the 11m trees planted in a Turkish mass planting program may be dead, judging from initial inspection results. It looks as though the trees were not planted correctly.

An 800MW tender for solar power in Qatar has drawn a new record low price of 15.67¢/kWh.

Greta Thunberg is to trademark FridaysForFuture along with her own name, to prevent others from monetising the movement (or her) without her consent.

Long Reads

A quick interview with Dr Katharine Hayhoe on how to approach discussing the climate crisis, regardless of your audience.

Over the past year, many climate models have suddenly started predicting much higher temperatures further into this century. The causes of this dramatic change are still not clear.

Quartz looks into the messy field of trying to assess the economic value of ecosystems, from whales to peatlands.

The story of the reintroduction of wolves to Yellowstone. 25 years on, the project is one of the biggest rewilding success stories ever.

The End Times

That’s all I have for you this week. As always, thanks for reading, and if you’ve any feedback or suggestions for me, I’d love to hear them (you can reach me at oli@forgethefuture.com). If you feel like sharing this, I’d massively appreciate it! See you next week,

Oli